Annual payment formula

Note that the carat indicates that youre raising a number to the power indicated after the carat. A Payment amount per period P Initial principal or loan amount in this example 10000 r Interest rate per period in our example thats 75 divided by 12.

Future Value Of An Annuity Formula Example And Excel Template

This is provided by the lenders as an annual rate.

. Nper Number of payment period. R Your monthly interest rate. CF Future Cash Flow.

Compound interest is a little trickier to calculate but you can use this formula to determine how much interest youll pay over the course of your loan. A P 1 r n n x t A. The annuity payment formula can be determined by rearranging the PV of annuity formula.

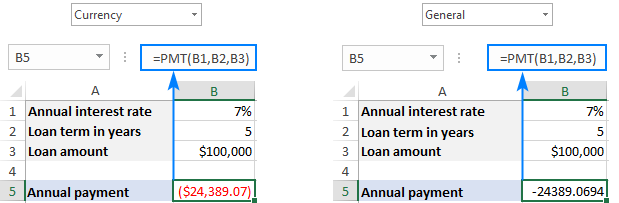

The annual repayment formula can be used to calculate any type of conventional loan including mortgage consumer and business loans. PMT 7 5 100000 To find the. Assume that the balance due is 5400 at a 17 annual interest rate.

Effective Annual Rate 1 nominal interest rate number of compounding periods number of compounding periods 1 For example. This can be further. However the formula calls for the.

Formula For PV is given below. Annual coupon payment 2 Half-yearly coupon payment 2 25 50 Therefore the calculation of the coupon rate of the bond is as follows Coupon Rate of the Bond will be. Union Bank offers a nominal.

Generic formula PMT rate periods - amount Summary To calculate a loan payment amount given an interest rate the loan term and the loan amount you can use the PMT function. Pmt Payment per period. A P r 1r n 1r n -1 Where.

To calculate principle paid in an EMI below formula is used. Where PV Present Value. T Number of Years.

After rearranging the formula to solve for P the formula would become. Equation for calculate annual payment present worth is A PV 1i n-1 i 1i n Where A Annual Payment PV Present Worth Value i Interest Rate Here i i100 n Number of. R Discount Rate.

Fixed Monthly Mortgage Repayment Calculation P r 1 rn 1 rn 1 where P Outstanding loan amount r Effective monthly interest rate n Total number of periods. A the future value of the investment including interest PMT the payment amount per period r the annual interest rate decimal n the number of compounds per. PV CF 1 r t.

For these fixed loans use the formula below to calculate the payment. Therefore the calculation of annuity payment can be done as follows Annuity r PVA Due 1 1 r -n 1 r Annuity 5 10000000 1 1 5 -20 1 5. Annual loan payment formula is defined as AP rP.

For example if you borrow 100000 for 5 years with an annual interest rate of 7 the following formula will calculate the annual payment. Nothing else will be purchased on the card while the debt. Figure out the monthly payments to pay off a credit card debt.

A The total monthly EMI payment. In case of multiple compounding per year. PPMTratepernperpv Where pv Present value of loan.

Be sure you are consistent with the units you supply for rate and nper. If you make monthly payments on a three-year loan at an annual interest rate of 12 percent use 1212 for rate and.

Excel Pmt Function With Formula Examples

Annual Percentage Rate Apr Formula And Calculator

Present Value Of An Annuity How To Calculate Examples

Excel Pmt Function With Formula Examples

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Solved Economic Formulas Are Available To Compute Annual Chegg Com

Excel Formula Estimate Mortgage Payment Exceljet

Loan Repayment Calculator

/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Fv Function In Excel To Calculate Future Value

Excel Formula Calculate Payment For A Loan Exceljet

Loan Payment Formula With Calculator

Annuity Formula What Is Annuity Formula Examples

Future Value Of Annuity Formula With Calculator

Equivalent Annual Annuity Formula With Calculator

Excel Pmt Function With Formula Examples

4 Ways To Calculate Annual Salary Wikihow